Home Insurance Myths: What’s Actually Covered and What’s Not

When it comes to protecting your home, you want to be certain that your insurance policy has you covered in times of need. You’ve worked hard for your home, and you deserve the peace of mind that comes with knowing exactly what your policy includes—and what it doesn’t. At Wells Insurance, we understand that clarity and trust matter. That’s why we’re here to dispel common home insurance myths and help you make informed decisions with confidence.

Myth #1: "My Home Insurance Covers Everything"

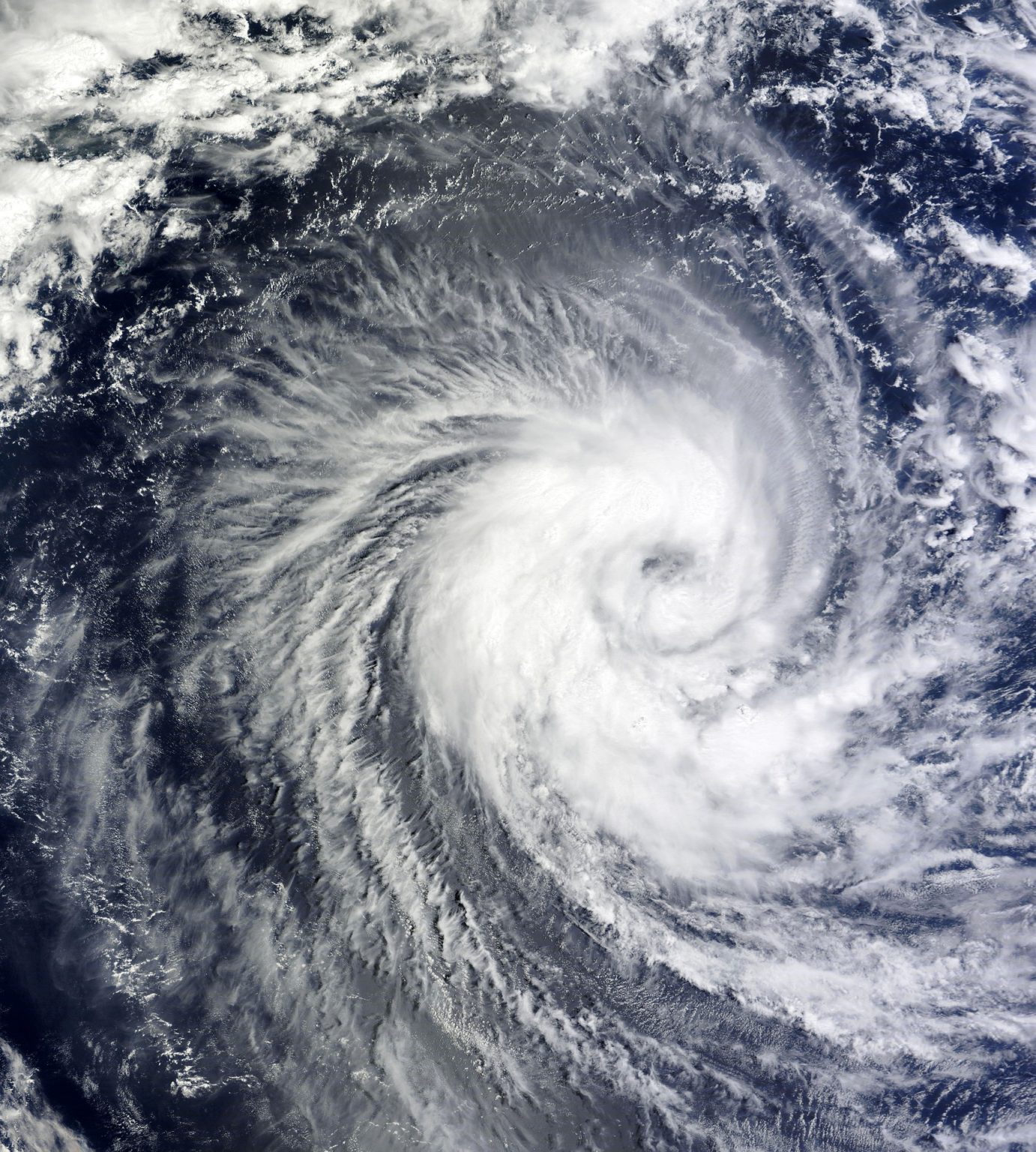

One of the most common misconceptions about home insurance is that it offers blanket protection for any type of damage. While your policy does provide broad coverage, it has limitations and exclusions. Standard policies typically cover damages caused by fire, windstorms, hail (unless you live in an area prone to Wind/Hail), theft, and certain types of water damage. However, natural disasters like floods and earthquakes often require separate policies.

One of the most common misconceptions about home insurance is that it offers blanket protection for any type of damage. While your policy does provide broad coverage, it has limitations and exclusions. Standard policies typically cover damages caused by fire, windstorms, hail (unless you live in an area prone to Wind/Hail), theft, and certain types of water damage. However, natural disasters like floods and earthquakes often require separate policies.

What You Can Do: If you live in an area prone to windstorms, hail, flooding, wildfires, or seismic activity, consider additional coverage to ensure your home is fully protected.

Myth #2: "Home Insurance Covers All Water Damage"

Water damage is one of the trickier areas of home insurance. While a sudden pipe burst is usually covered, gradual leaks, sewer backups, or flooding from heavy rain typically aren’t. Many homeowners are surprised to learn that flood damage requires a separate flood insurance policy.

Water damage is one of the trickier areas of home insurance. While a sudden pipe burst is usually covered, gradual leaks, sewer backups, or flooding from heavy rain typically aren’t. Many homeowners are surprised to learn that flood damage requires a separate flood insurance policy.

What You Can Do: Regular home maintenance can help prevent leaks. If you’re concerned about flooding, look into flood insurance through the National Flood Insurance Program (NFIP) or a private insurer. Not concerned about flood in your area? That may mean it is very affordable and could save you in the case of that 100 year storm.

Myth #3: "My Policy Covers the Full Cost of Rebuilding My Home"

While home insurance does provide coverage for rebuilding, the amount covered depends on your policy limits. If your coverage amount is based on your home’s "market value" rather than its replacement cost, you may find yourself overinsured or underinsured in the event of a total loss.

While home insurance does provide coverage for rebuilding, the amount covered depends on your policy limits. If your coverage amount is based on your home’s "market value" rather than its replacement cost, you may find yourself overinsured or underinsured in the event of a total loss.

What You Can Do: Call or visit your insurance advisor to work with them to ensure your coverage is based on the true cost of rebuilding, including labor and materials, which can fluctuate over time.

Myth #4: "Personal Belongings Are Covered at Full Value"

Your home insurance policy does include coverage for personal belongings, but it may not always cover their full replacement cost. Standard policies often reimburse based on actual cash value, which factors in depreciation.

Your home insurance policy does include coverage for personal belongings, but it may not always cover their full replacement cost. Standard policies often reimburse based on actual cash value, which factors in depreciation.

What You Can Do: If you have valuable items such as jewelry, antiques, or collectibles, consider additional riders to cover them at their full replacement value.

Myth #5: "If Someone Gets Hurt on My Property, I’m Always Covered"

Home insurance includes liability protection, which helps cover medical expenses and legal costs if someone is injured on your property. However, if the injury results from negligence, or if certain dog breeds or high-risk features like trampolines or pools aren’t disclosed to your insurer, your claim could be denied.

Home insurance includes liability protection, which helps cover medical expenses and legal costs if someone is injured on your property. However, if the injury results from negligence, or if certain dog breeds or high-risk features like trampolines or pools aren’t disclosed to your insurer, your claim could be denied.

What You Can Do: Review your policy’s liability limits and discuss any potential risks with your advisor to ensure you have the right level of protection. Be honest with your agent if you have trampolines or pools, which are considered an "attractive nuisance".

Myth #6: "Home Insurance Covers Home-Based Businesses"

If you run a business out of your home, don’t assume your home insurance policy automatically covers business-related losses. Most standard policies exclude coverage for business equipment and liability related to home-based operations.

If you run a business out of your home, don’t assume your home insurance policy automatically covers business-related losses. Most standard policies exclude coverage for business equipment and liability related to home-based operations.

What You Can Do: If you work from home, talk to your insurance provider about adding a business endorsement or purchasing a separate business insurance policy.

Building a Relationship Based on Trust

At Wells Insurance, we believe that home insurance should never be a guessing game. We’re here to help you navigate the fine print and ensure your policy aligns with your unique needs. If you have questions or want to review your current coverage, let’s talk. You deserve an insurance partner who values clarity, respect, and your long-term peace of mind.

Ready for a review? Reach out to a Wells Insurance agent. Feel free to call (910-762-8551) or stop by one of our offices in Downtown Wilmington, Oleander Dr - Wilmington, Brunswick Forest, or Southport to speak to one of our advisors today to discuss your coverage options and make sure your home is protected the way it should be. Feel free to call us