What's the difference between named storm vs. wind & hail deductible?

Meleah Sheridan

Account Executive

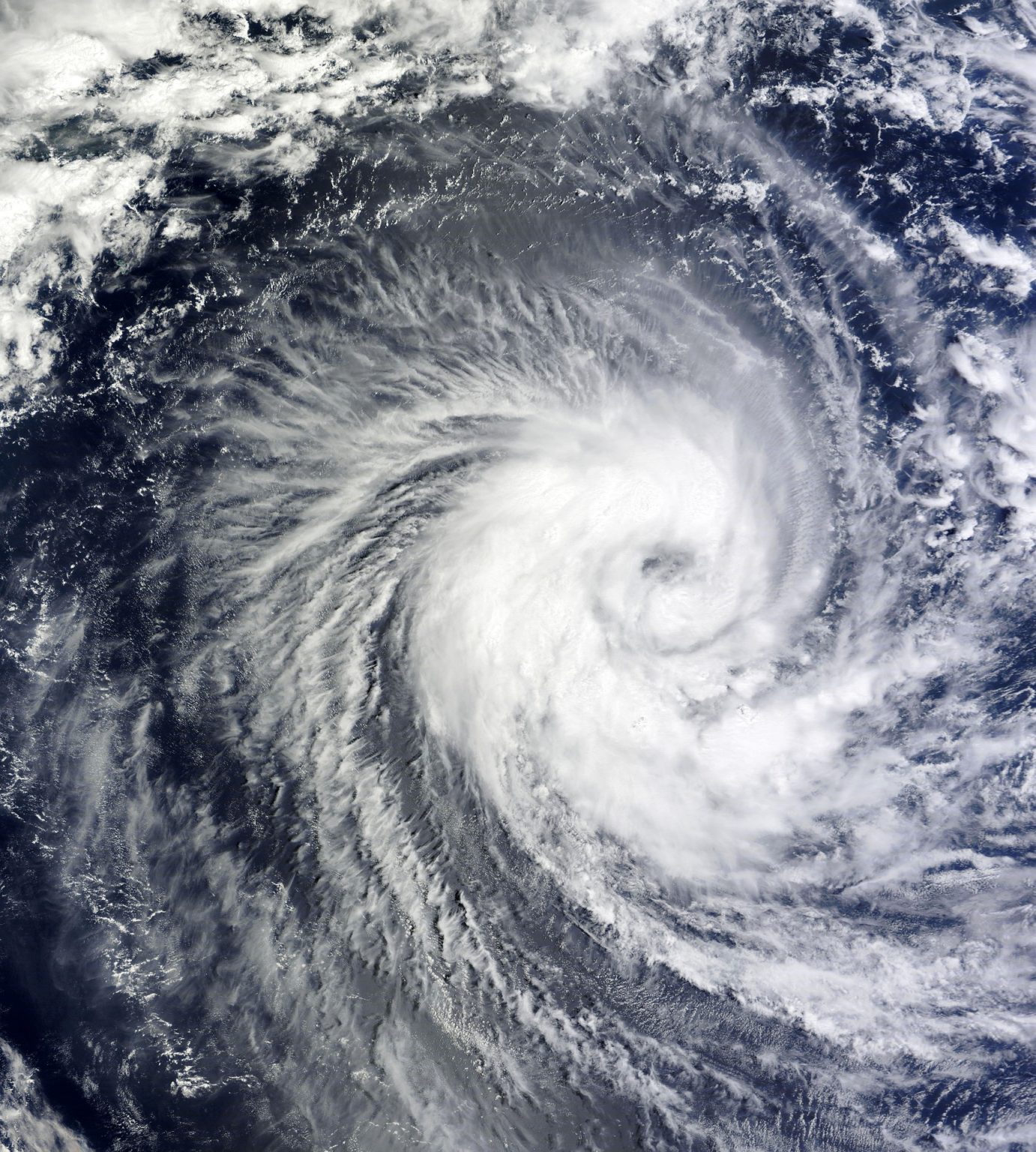

"A named storm deductible applies specifically to storms (most commonly hurricanes and tropical storms) that are named by the National Weather Service. They are typically structured as a percentage of the dwelling coverage and usually start at 1%. So if the dwelling limit / coverage A of your home is $300,000 and you have a 1% named storm deductible, you would pay a $3,000 deductible for losses caused by a named storm. A wind policy may have an all other peril deductible listed as well, and it is usually a flat amount, like $2,500 or $5,000. On the wind policy, this would apply if wind or hail caused damage to the property but the storm system was not named by the National Weather Service."

"On a homeowners hazard policy with wind and hail excluded, an all other peril deductible would usually refer to covered losses besides those caused by wind or hail. The all other peril deductible would apply to lightning, fire, water damage caused by a burst pipe, etc. In a homeowners policy with wind included, the all other peril would apply to all other covered losses and the named storm or wind deductible would determine how wind losses were covered."

"On a homeowners hazard policy with wind and hail excluded, an all other peril deductible would usually refer to covered losses besides those caused by wind or hail. The all other peril deductible would apply to lightning, fire, water damage caused by a burst pipe, etc. In a homeowners policy with wind included, the all other peril would apply to all other covered losses and the named storm or wind deductible would determine how wind losses were covered."

Always feel free to please give us a call or shoot us an email if you have any further questions!

910.762.8551

Insurance@wellsins.com