Factors Driving a Hardening Insurance Market and How To Respond

From an insurance buyer’s perspective, it can sometimes feel as if premium prices change on a whim. But the truth is that the insurance market is cyclical in nature, fluctuating between soft and hard markets:

- Soft markets—A soft market, which is sometimes called a buyer’s market, is characterized by stable premiums, broader terms of coverage, increased capacity, higher available limits and competition among insurance carriers for new business.

- Hard markets—A hard market, which is sometimes called a seller’s market, is characterized by increased premiums, diminished underwriting appetite and capacity, restricted coverage and less competition among insurance carriers for new business.

While many insurance buyers have enjoyed a soft market for years, the market is hardening. As a result, everyone now faces tough choices regarding their insurance, making it all the more important for them to understand what to expect in a hardening market and how to respond effectively.

Factors Contributing to a Hardening Market

In what was one of the longest soft markets in recent years, people enjoyed stable premiums, competitively low rates, and expanded coverage for decades. However, after years of gradual changes, the market is firming, leading to increased premiums and reduced capacity.

A number of different factors affect insurance pricing, but the following are common contributors to the hardening market:

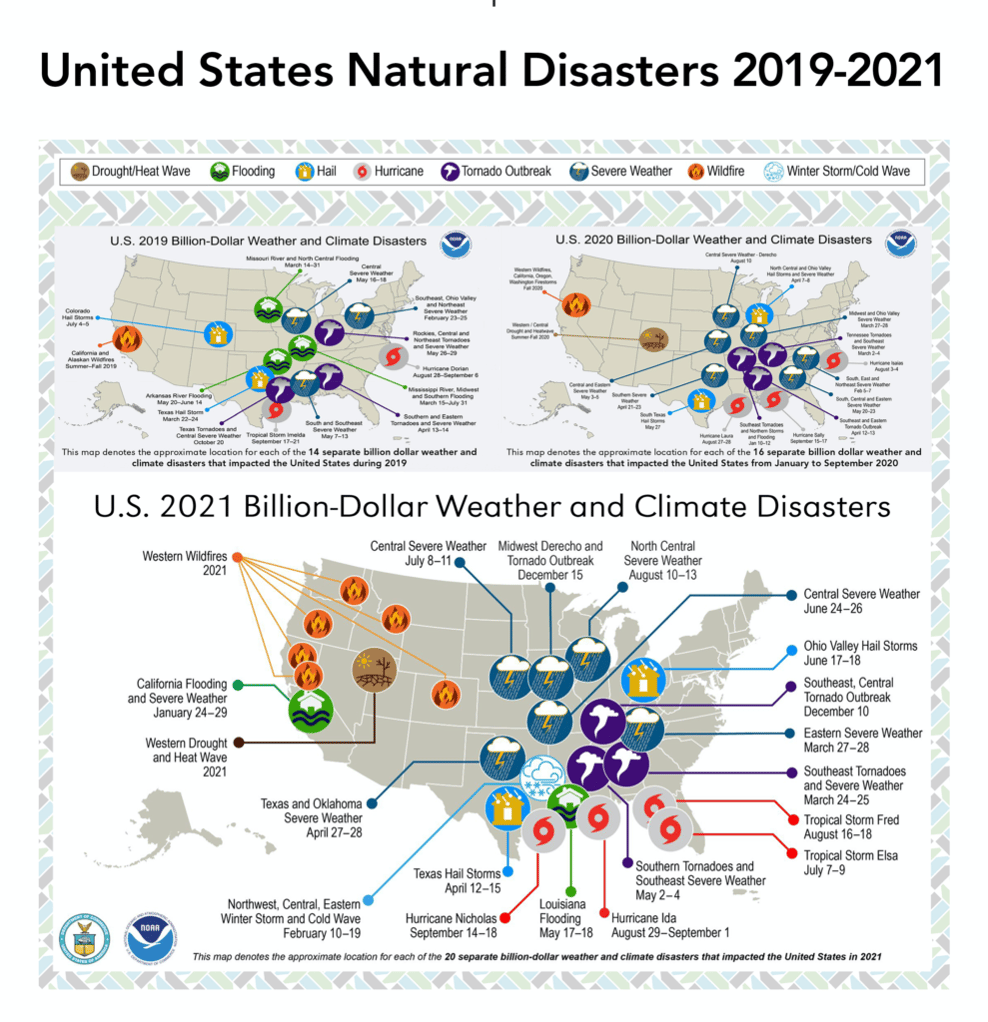

- Catastrophic losses—Floods, hurricanes, wildfires and similar disasters are increasingly common and devastating. Several years in a row of costly disasters like these have compounded losses for insurers, driving up the cost of coverage overall. (See above graphic)

- Claims costs—Claims are increasing in both frequency and severity year over year.

- Underwriting standards—Insurers are struggling to overcome underwriting losses, especially given how low interest rates have remained in recent times. This has made carriers more cautious, and many are restricting the types of insurance they are willing to underwrite. What’s more, they are removing coverages that were once offered.

- Investment returns—Nearly every insurance carrier uses the funds it receives from premiums to invest in other markets. However, reduced interest rates have negatively impacted profitability, and carriers have a reduced their appetite for risk as a result.

- Reinsurance—Reinsurance is coverage for insurance companies. Carriers often buy reinsurance for risks they can’t or don’t wish to retain fully. However, reinsurance is becoming more expensive to obtain, which is causing carriers to increase their rates.

What to Expect During a Hard Market and How to Respond

Everyone will have to adapt to the hard market, and can expect to face:

- Higher premiums

- Increased scrutiny when it comes to underwriting (e.g., underwriters asking for more information regarding risks)

- Coverage restrictions (e.g., increased retentions) or exclusions

- Conditional or non-renewal notices

Put simply, during a hard market, insurance buyers may face difficult decisions regarding their insurance coverage. Thankfully, however, we are not without recourse in the face of a hard market. The following are some strategies to consider to help navigate shifts in the market:

- Review your insurance program. Above all, check that your policies account for your greatest exposures. An understanding of your coverage ensures you’re not overlooking any exclusions and will help you secure the right policy for your home, auto, or personal assets. During a hardening market, it may be necessary to make adjustments to your policies. However, those adjustments shouldn’t come at the expense of the coverage you need.

- Bolster your risk management efforts where possible. Doing so makes you more attractive to insurers. Your broker can also help you review existing policies and make suggestions on ways to reduce your risk of liability by being proactive.

- Know your loss history. In a hard market, underwriters will be especially critical when reviewing loss trends. Be prepared to explain the factors contributing to a specific loss and the steps you’ve taken to mitigate future losses.

- Budget wisely and plan ahead. In some cases, premium increases are unavoidable, and homeowners should be prepared. Budget accordingly and take insurance costs into account when renovating, making plans for the year ahead, etc.

- Work with the right insurance broker. During a hard insurance market, it’s vital to have a competent insurance professional advising you. Be sure to partner with a broker that has strong carrier relationships and knowledge of your area.

- Communicate with your broker early and often to determine how the hard market may affect you. Starting the renewal process early can give your broker more time to secure the best coverage for you.

Families who proactively address risk, control losses and manage exposures will be better prepared for a hardening market than those who do not. Work with your broker now to prepare your family for changes down the road. Contact Wells Insurance today if you have questions or concerns. insurance@wellsins.com 910.762.8551